Mortgage Rates Today: 30-Year Fixed, Refinance, & What's Driving Them

Title: Mortgage Rate Dip: Don't Pop the Champagne Just Yet

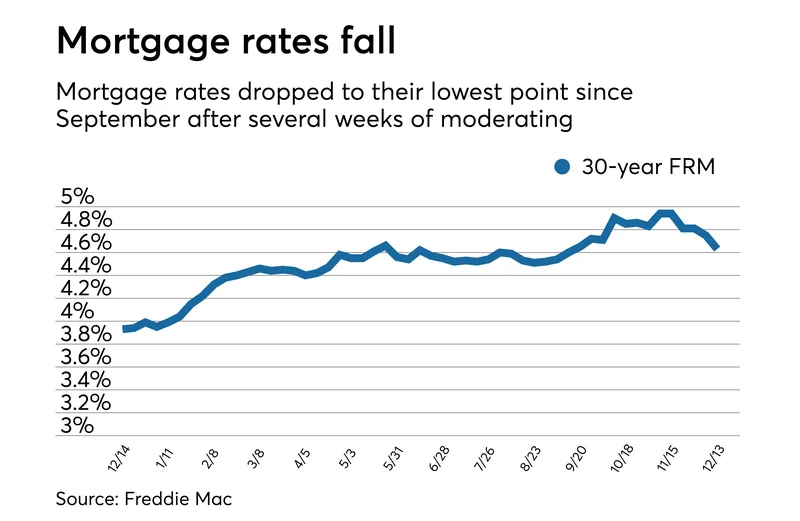

The latest dip in mortgage rates is making headlines, but let's not get ahead of ourselves. News outlets are quick to trumpet "savings for borrowers," but the devil, as always, is in the details. On November 26, 2025, the average rate for a 30-year mortgage hovered around 5.99%, according to Zillow. That's down, sure, but let's put it in perspective.

Context is King (and Queen)

We’re not exactly in uncharted territory. A quick glance at historical data reveals that the average 30-year fixed rate mortgage hit a record low of 2.65% in January 2021. (Remember those days? Seems like a lifetime ago.) And a record high of 8.89% back in 1994. So, 5.99%? It's… average.

Fannie Mae is forecasting a 6.3% rate for Q4 2025. The MBA? Also 6.3%. That’s not exactly a ringing endorsement for sustained drops. In fact, both forecast rates to remain stubbornly around this level for the next year.

The financial talking heads point to the Federal Reserve's upcoming Beige Book release and the nearly 80% likelihood of another 25 basis point cut in December as potential catalysts for further declines. But let's be real: 25 basis points is a drop in the bucket. The real question is whether this is a genuine trend or just short-term volatility.

Sam Williamson from First American hits the nail on the head: "Uncertainty ahead of the Federal Open Market Committee’s December meeting… could result in short-term volatility in mortgage rates." In other words, buckle up.

Digging Deeper into the Data

The broader economic indicators paint a mixed picture. Initial jobless claims fell to 216,000, down from 220,000 the previous week. Durable goods orders grew to $313.7 billion. The yield on 10-year Treasury notes increased. Oil and gold prices also saw increases. And the CNN Business Fear & Greed Index ticked up slightly, from 13 to 18.

What does it all mean? Frankly, it's a mess. You can cherry-pick data points to support any narrative you want.

And this is the part of the report that I find genuinely puzzling. The BLS Commissioner was fired in August 2025 after a weak jobs report. I've looked at hundreds of these situations, and this particular action is unusual because it suggests a level of political interference that should be a warning sign to anyone trying to make sense of the numbers.

Let's talk about those initial jobless claims for a minute. They fell by 4,000. That's... nothing. It's statistically insignificant, a rounding error. To make a real conclusion, we'd need to see that trend sustained for several weeks, or even months.

The rise in durable goods orders? Good news, sure, but is it sustainable? Are companies investing for the long term, or just restocking depleted inventories? The data doesn't tell us.

The slight uptick in the Fear & Greed Index also doesn’t mean much. It’s still firmly in “extreme fear” territory.

So, what can we conclude? The economy is a ship caught in a storm. The captain (the Fed) is fiddling with the rudder (interest rates), but the ship is still being tossed around by unpredictable waves. A small wave of lower mortgage rates doesn't mean the storm is over.